Make Your Wallet Happy By Earning

on balances of $1,000 or more with our High Yield Savings account.

Make Your Wallet Happy By Earning

FDIC INSURED

Deposits are FDIC insured up to $250,000

NO MAINTENANCE FEES

No account opening or monthly service fees

COMPETITIVE RATES

Earn more than 10x the national average on your savings1

Trusted in Kentucky for 150 Years

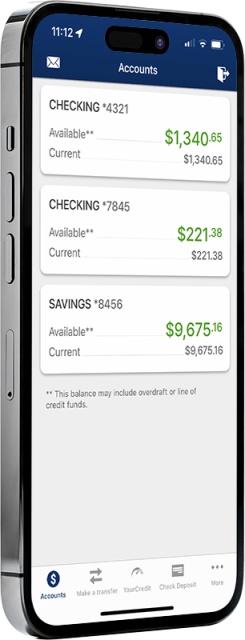

OUR MOBILE BANKING APP GIVES NEW MEANING TO POCKET MONEY

Turn your smartphone into a financial wiz with FNB’s Mobile Banking App for iPhone, iPad and Android.

- Manage your finances from your phone

- Safe, easy, and secure transactions

- Easily manage bill pay options

- Track income and expenses

- Take control of your money with our budgeting tools

Safe, Secure and Backed by the FDIC

Frequently Asked Questions

FNB Bank, founded in 1875 in Mayfield, Kentucky, is one of the state’s oldest banks and ranks among the highest in the nation in safety and soundness practices. The bank offers a comprehensive range of financial services for both personal and business needs. FNB has been recognized for its commitment to promoting savings among its customers and has earned the America Saves Designation of Savings Excellence award three times – in 2021, 2023, and 2024. The prestigious honor is reserved for financial institutions that demonstrate exceptional achievement during the annual America Saves Week campaign. Beyond FNB’s savings accolades, the bank is committed to offering competitive savings products designed to meet diverse financial goals. Due to this commitment, FNB is offering competitive savings and certificate of deposit (CD) products. You can bank confidently knowing that FNB has been a trusted savings source in Kentucky for the last 150 years.

We utilize industry-leading security measures, such as encryption, firewalls, and secure login protocols, to ensure your information remains protected.

- Social Security Number

- Driver’s License or other valid state ID

- Mailing Address (not a PO Box)

- Routing Number and Account Number of the account you will use to fund your new account

Notify us by completing our contact form below.

If you think your identity or financial accounts have been compromised, please use the contact form below.

Your savings at FNB Bank are FDIC-insured up to $250,000.00 per depositor, for each account ownership category. To learn more about FDIC insurance, contact the FDIC at 1-877-ASK-FDIC (1-877-275-3342) or visit www.fdic.gov.

Have More Questions?

Fill out the form below and we’ll get right back to you.

Please Note: Your inquiry should not contain sensitive information (e.g., Social Security number, account numbers or other personal information), which may not be securely transmitted via Email.

*Annual Percentage Yields (APY) and balances information will remain in effect for 90 days after the account is opened, after which time rates and balances may change. Rates may vary daily and may change after account opening. For balances under $1,000, a standard savings rate of .25% APY will apply. Interest paid is compounded and credited monthly. If closed before interest is credited, accrued interest will not be paid. Fees could reduce earnings on account. Minimum opening deposit of $1,000. Offer available to consumers at least 18 years of age (not available to businesses or public funds) and subject to change at any time. See disclosures for full terms and conditions.

1Based on National Deposit Rates for Savings Products as published by the FDIC on December 15, 2025.